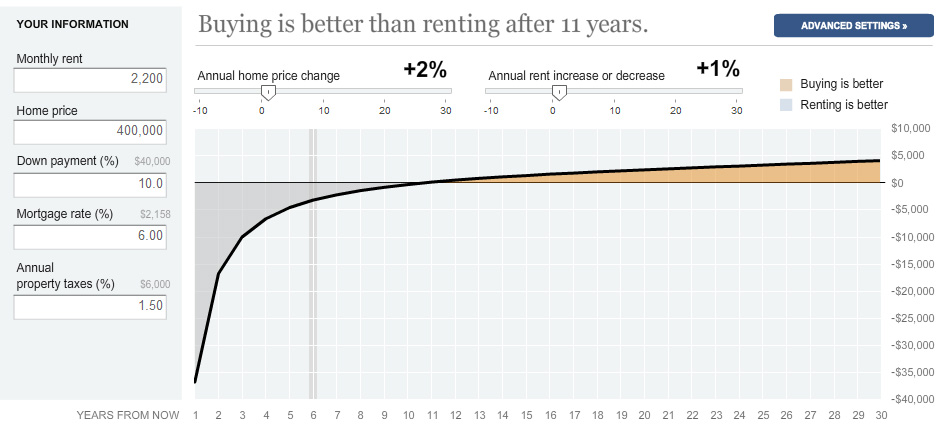

I love interactive maps and calculators and there’s almost nothing I love watching more than the Rent vs. Buy data from quarter to quarter. Trulia leads the way in collecting this data and offering it in an easy to read interactive, but a great way to get a more personal reflection of whether renting or buying is a better option, or when it will come a better option than renting is through the New York Times Calculator below. Based on my own personal information for the city I currently live in, renting is the better choice for up to 11 years – after that buying is a better option.

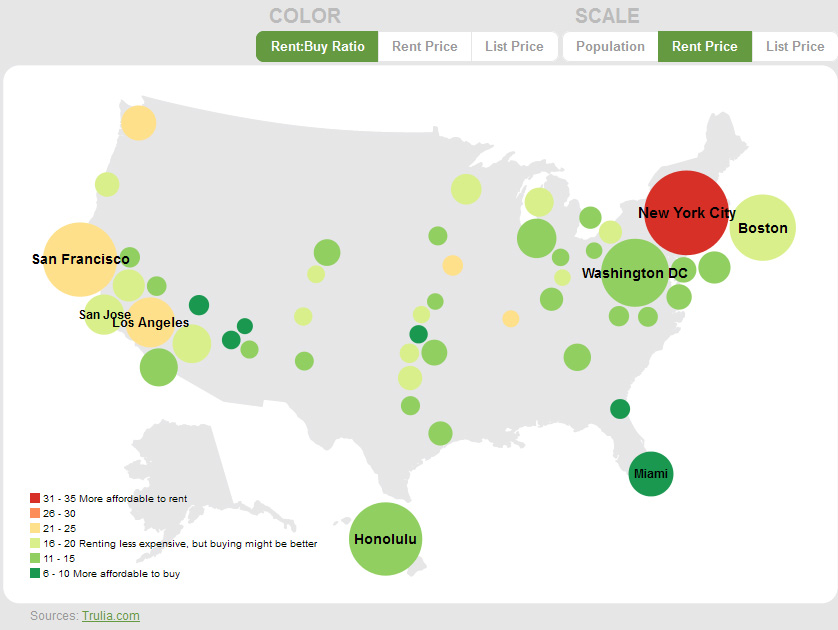

However, according to this past quarter’s Trulia data, buying is a better option in most large metros. Trulia identifies affordability based on a particular methodology that you can read about here, but basically a score of 14 or lower means it’s more affordable to buy a property than rent. Anything above a 15, and it’s usually better to rent than to buy.

This year’s Trulia data (in the above image) does not go into detail on prices, unlike the 2011 data which included average rental and purchase prices, as well as data on unemployment and job growth. (I wonder if the launch of their mortgage center has anything to do with this? Hmm….)

But if you go to the Trulia blog, they have previous quarters analyzed in more detail like the July 2011 map -a score of 13 to 18 is still cheaper to rent, but buying might be a better option. A score below 14 is a good indicator of buying might be a better option.

This map and data can be used for prospective and current homeowners, as well as people looking to get into the rental business; if you can afford properties in areas where it might be better to rent or it’s a wash, you may make a killing on rental income over the next few years.

As one who would like to purchase property sometime in the near future and is willing to move, it’s also a great way for me to narrow down cities I’ve already been eying.

Are you looking to purchase a property soon?

9 Comments

I already bought a property a little more than a year ago here in Florida. For me, buying was definitely much cheaper than renting even if I spend a significant amount of money on repairs every year.

@Lance – When I was checking out the rent/buy maps, I noticed that there are a lot of cities where buying makes way more sense than renting. I hope to move to one someday! 😉

In the real estate market that I live in, buying definitely makes more sense than renting. But I do think our nation’s recent housing woes have not made that decision as much of a no-brainer as it used to be. Interesting info!

@Julie – That’s for sure. The housing marketing and economy have slowed the purchasing of properties way down. I’m sure it will correct itself over the next couple of years.

Honestly speaking NY scares me!

@Michael Davis – Me too! Thankfully, I can visit NYC anytime and stay with family. 😉

We are getting ready to put our home on the market in Phoenix, Arizona and it is a great time to sell as there are not many homes on the market in our neck of the woods. Rents have gotten out of hand and are higher than buying in most cases!

@Paul – I know a little about Arizona since I have family there so I can see why rents are probably rising fast. Glad to hear that in your area, homes are selling well. Good luck with your sale!

This is such a clever tool. In spite of the analysis, I think there is an element apart from finance in making this decision. Some folks do not want the responsibility and commitment of owning, while others wouldn’t have it any other way!