I remember when my parents purchased their first house in 1978 in Granada Hills. They bought a 3-bedroom, 2-bath fixer-upper for $68,000. I was 7 and very excited to have neighbors with small children to play with. My parents spent the first few months replanting the lawn and garden, tearing out old bushes and planting new flowers. Over the next few years, they lost a little steam, adding brick to the front of the house, but then only painting the front a grayish-blue and leaving the sides and the back the old yellow it had previously been. They lived in that house 12 years, selling it in 1991 for $189,000. As they moved 2 hours north of me, I stayed behind to finish college. I’ve never left, I live 6 miles from where I grew up as a child.

I grew up with the notion that everyone eventually owns a home with a yard for their children to play in and a yard for a garage sale (see how to yard sale). This is something my parents were able to easily do. Yet, a home purchase has eluded my husband and me. Years ago, when my husband and I were in the early stages of our relationship, we happened upon an open house in an older, yet respectable neighborhood. The house was selling for $110,000. It was a 750 square foot, 2-bedroom, 1-bath house with a somewhat prestigious zip code. At the time, we knew nothing about purchasing a house. We were under the impression that we would never qualify, nor did we know what it would take to qualify and actually purchase a house. So, we made the decision to continue renting.

Then something began to happen in the surrounding neighborhoods that we couldn’t make head or tails out of. The housing prices began to sky rocket: $300K, 350K, 450K, 550K, 628K for a 1000 sq ft starter home, or what most would consider a starter home. These prices weren’t just homes in Malibu or on the ocean, these were homes in our somewhat run-down neighborhood. We started to realize owning a home in a suburb of LA was an impossible dream for us.

In December of 2005, during the peak of the housing market, we decided to move out of our 2-bedroom apartment into a 3-bedroom rental house. This was the closest we could get to living in a house with a yard and private garage. As I became acquainted with the neighborhood through evening walks, I would cringe at the For Sale signs with price tags of $525,000 and up. I couldn’t figure out how these people were doing it, purchasing homes for over half a million dollars. One sign I made a mental note of was a sale sign detailing out the monthly mortgage payment, I nearly choked. Not because it was excessive, quite the contrary, this particular home was selling for $529,000. The monthly mortgage price they were claiming a purchaser would pay was only $1,349! This was almost $500 less than our monthly rent. I remember thinking, “How is that possible? The math doesn’t work out unless you pay that amount for almost 100 years!” Something smelled fishy.

Then things began to fall into place and make sense. Mortage brokers were allowing unsuspecting homeowners to take out negative ARM loans. Their monthly payment was less than the interest due on the house. With lax qualifying measures, anyone could purchase a home, but the catch was they would have to pay for it later. Many people probably thought, “Oh, I’ll sell it for a profit before the time comes that I have to pay principal plus interest.” Unfortunately, that time never came.

Mid-2008, the fish smell materialized and it all became clear. Recent purchasers were loosely qualifying for these quasi-loans that allowed them to pay less than the interest on the home. Once their 5-year ARM reset, they would have to pay 3-4 times more than their current monthly mortgage payment. Most people would not be able to afford this once this happened. Hence, all the foreclosures that are now in my neighborhood. With banks realizing their huge mistakes, they began to realize many of these loans would never be paid in full. Now, many homeowners are underwater, owning way more on their home than their home is worth.

When I ride my bike through the neighborhood I can’t help but see the neglect of homes with overgrown lawns, the sales signs on some houses are foreclosure property, others are on their way to being foreclosures. My husband and I aren’t realtors or bankers, yet we called this bubble breaker back in 2007. We knew that most people didn’t make $250K a year in salary, the standard income ratio of 2.5 times the house price. There wasn’t any reason to believe these people were making more than twice as much as us. We also knew houses couldn’t continue on this escalator forever, if it did, how would people qualify for a 1 million dollar home in the future?

Many realtors were lead to believe this housing boom would last forever, housing prices would never decrease. But looking as 10 year trends in the neighborhood, I could see that this “bubble” didn’t make any sense over time. A steady price increase is normal, the huge jump is not.

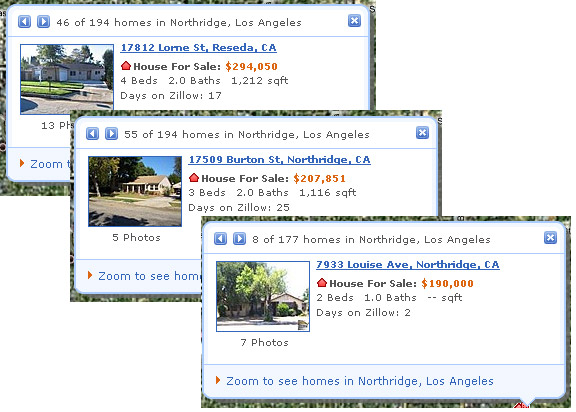

I used the Zillow home value index chart to show home values over the past 10 years in my neighborhood since it’s easier to read over time. When I looked at the prices homes sold for, it was all over the place and made it difficult to see the increase vs. decrease over time. Yet, the end results were similar. The dark orange line is the neighborhood I currently live in. This chart is estimating home prices just below $400K, still too pricey for my husband and me. However, the sales list on Zillow shows some homes selling for below $300K. Below is a sampling of homes listed in my neighborhood that are well below the average $387,800 price tag:

If all goes as planned, by mid-next year my husband and I should be in one of these affordable, fixer-uppers. We’ll be happily fixing up our little house in the valley.

2 Comments

Your parents bought and sold their home around the same time mine did, over here on the East Coast, at similar prices. When my husband and I bought our home a few months ago, my father called the asking prices in our area “telephone numbers” — because the numbers seem so large.

But prices have come down since the bubble, and with the $8K first-time homebuyer credit, it seemed to be the right time for us to buy. I will keep my fingers crossed that you’ll enjoy the trials and tribulations of home ownership soon, too!

Thanks RainyDay,

I do believe that we’ll purchase our first home with in the next 6-9 months. It always amazing me the similarities between the east and west coast.

Thanks again,

Little House